On May 8, 2018, SB 194 was signed into immediate effect by Governor Nathan Deal. The bill, sponsored by Senate Judiciary Committee Chairman Jesse Stone, amended the 2016 rewrite of Georgia’s garnishment law to correct unintended errors or oversights in the law. In summary, the bill contained the following changes:

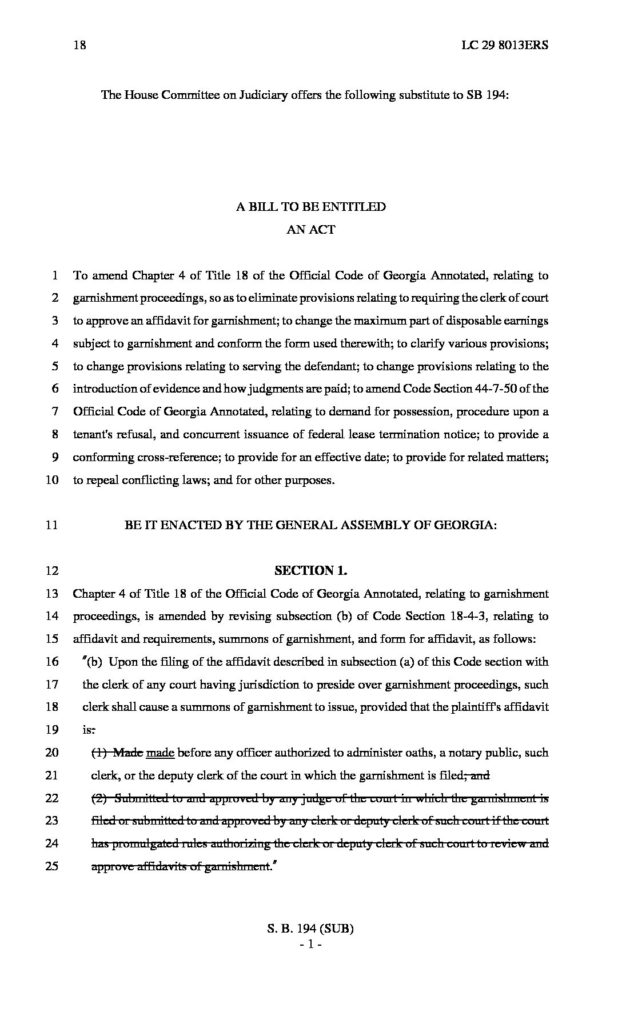

- Section 1 removed any requirement for the clerk of court or judge to make a determination about the sufficiency of the contents of the affidavit of garnishment.

- Section 2 replaced the incorrect calculation of 30 hours of

minimum wage at $7.25/hour from $217.00 to $217.50 in the statute. - Section 3 clarified that a continuing (wage) garnishment at a financial institution is indeed possible and that only the “form for” the summons of garnishment on a financial institution is prohibited when the primary purpose is a continuing garnishment against an employee/benefits recipient of the institution [Note: some had argued that the prohibition on “a summons” of garnishment at a financial institution resulted in a prohibition of any continuing garnishments of financial institution employees, even if the continuing garnishment form is used].

- Section 4 closed a loophole that might have allowed some judgment defendants (e.g. bankruptcy non-dischargeable and creditor-suing) to be immune to garnishment by moving to an unknown address because there would be no address for service in the “action resulting in the judgment” to which to send regular-mail notice under the catch-all provision in subsection (C) of 18-4-8(b)(1). It also removed any requirement for the clerk of court

- Section 5 clarified that the automatic dismissal of a garnishment action when no new summons issues and no funds are in the hands of the court within 30 days happens only after two years.

- Section 6 corrected two things:

- It clarified that the 2016 garnishment rewrite did not intend to and does not circumvent the court requirements of real-party-in-interest/standing when making claims toward garnished property – defendants may only speak for themselves, and third-party claimants for themselves, never one for the other. However, this doesn’t prevent defendants from identifying and giving notice to third-party claimants.

- It fixed an error that would have caused a double penalty to garnishees losing on a traverse of answer by mandating a judgment issue for funds still owed and funds already paid into the registry of the court [i.e. judgments against garnishees will now only be for any difference between the amount found to be owed and the deposited amount].

- Section 7 added the exemption calculation correction from Section 2 to the informational notice form the Defendant receives.

- Section 8 fixed a referential error in the dispossessory statute requiring a plaintiff’s affidavit to be as prescribed by the garnishment statute, which would be wholly inapplicable in most dispossessory cases. It also made some updates to the statutory language of that section.